- The Tech Buzz

- Posts

- Exploring Femtech

Exploring Femtech

A hand-written industry deep dive

This article was researched and written by Caroline Keohane, a contributor to and friend of The Tech Buzz.

Imagine a market targeting every second human being, desperately in need of innovation.

That is essentially a startup's dream, right? Well, dream no longer- it exists, and it is called, somewhat controversially, “Femtech.” Femtech companies specialize in innovative solutions for problems that disproportionately affect women.

The companies taking advantage of this emerging market address issues in categories including fertility, birth control, menstruation and period care, menopause, chronic conditions, and hormonal disorders, pelvic health, pregnancy and post-pregnancy care, breastfeeding, and sexual wellness, incorporating modern technology in their solutions.

Historic Inequality in Medicine

Women have existed for as long as the healthcare system, so why is Femtech an emerging industry? It stems from deeply rooted biases in the male-dominated medical field that have historically neglected women's health.

It was not until 1993 that Congress passed the NIH Revitalization Act, mandating that women be included in medical studies. Even so, Dr. Lyndsey Harper, Obstetrician-Gynecologist and founder of Rosy Health, a female sexual health startup, claims that “That law still doesn’t mean they were included in clinical trials.”

To this day, studies are frequently granted exemptions due to the increased cost associated with women's inclusion in medical trials. Dr. Harper says even now, “It's all based on men, 100%.”

The results of male trials are then projected onto women without understanding female physiology and how it differs from men.

Women experience a slew of health conditions that men do not, but they have largely been ignored and considered “taboo.”

According to a McKinsey Health Institute Report, to this day, only 4% of U.S. health tech research and development spending goes to diseases that primarily impact women, despite women making up around 50% of the population.

To put things in perspective, in the U.K., erectile dysfunction, which less than 20% of men will experience in their lives, receives five times the amount of research funding that premenstrual syndrome does, which about 75% of women will experience.

While these health problems have always existed for women, they have never been addressed, or if they have, the current standards of care have not been innovated on due to a lack of research and funding and do not take advantage of the modern technologies available to make women’s lives easier and more comfortable.

Figure 1

An example is the tenaculum, shown on the left in Figure 1. It is a long metal, scissor-like tool with sharp hooks on the ends used in many intrauterine procedures.

This tool was invented during the Civil War and has not been innovated since, despite causing 90% of women unnecessary pain during procedures—pain so severe it deterred up to 30% of women from getting the procedures done.

It was not until 2015, when Aspivix, a Swiss medical device company, was founded, that a simple, effective, and affordable solution was created, decreasing pain by 73% and bleeding by 78%. It was not a revolutionary device, but no one had considered making it.

There is a gap that Femtech companies like Aspivix are working to fill. The market is large, and the space is ripe for innovation. However, securing funding is an uphill battle for these companies due to historical inequalities, data barriers, censorship, and lack of education.

Historic Inequality in Investing

While anyone can start a Femtech company, the issues they solve disproportionately affect women, and thus, those coming up with the solutions are primarily women. Around 70% of Femtech startups are founded by women.

These companies are using innovative methods to address the most pressing female health concerns, yet many still struggle to receive funding.

89% of venture capital investors are men, who understandably do not have enough background in the female health field to make informed decisions.

Ikram Geurd, the VP of Global Marketing at Swiss medical device company Aspivix, said, “When we were pitching, the male investors didn’t understand. Many of them said, 'I'll have to go ask my wife.'”

Caroline Criado Perez expresses this gap in education in her book Invisible Woman: Data Bias in a World Designed for Men, writing, “It’s not always easy to convince someone a need exists if they don’t have that need themselves.” And it is even harder to convince people of that need without data.

Elina Velena, CEO and founder of Essence App, a menstrual well-being startup, lays out the issue in a Forbes interview: "We know that women raise less money than men. We know that most FemTech companies are founded by women. We know that investors prefer to invest in topics they can easily relate to (spoiler alert: not women’s health). Therefore, a female founder raising capital for a FemTech company faces a massive uphill climb. You’re a female raising capital—strike one. You’re a female raising capital in FemTech—strike two. The odds are stacked."

Karen Taylor, Research Director of the Centre for Health Solutions at Deloitte, believes, “If there was some more homework done by some of these investors, they’d understand why this is an area that is ripe for growth and investment.”

Regardless of the source of these biases against women's health companies, the fact that they are unable to receive funding limits their ability to innovate.

Dr. Harper explained that many companies, including her own, Rosy Health, aspire to do much more—they just don’t have the funding. “Baby checks,” she says, “result in small deliverables.”

The Impact of Education

Part of the reason for these “baby checks” from investors is a limited understanding of Femtech as an industry. There is an unfounded belief among some investors that the Femtech space is oversaturated, which stems from the perception that these companies are “niche.”

Anne Wanlund, founder of Canopie, an app designed to improve the mental health of expecting and new mothers, says when pitching to investors, “I heard the word ‘niche’ a lot.”

This is interesting, given that every year, there are over 230 million pregnancies worldwide, and the Centers for Disease Control and Prevention cites mental health as the number one cause of maternal mortality, responsible for 23% of pregnancy-related deaths.

Dr. Harper at Rosy Health faced similar investor misunderstandings, to which she replied, “How can something that affects more than half the population be too ‘niche’?” She even went as far as to trademark the slogan, “It’s not a niche bitch” to create awareness around the Femtech industry.

Apart from bias barriers, Femtech companies encounter data barriers as well.

Data

Solving any health problem begins with good data, and diseases that disproportionately affect women are lacking just that.

In a study conducted by the National Health Institute (NIH) on its own research practices, it concluded that “NIH applies a disproportionate share of its resources to diseases that affect primarily men, at the expense of those that affect primarily women.”

Part of this data disparity stems from a lack of diagnosis of women’s health conditions in the first place. According to a study conducted by The McKinsey Health Institute, 8 in 10 women are not diagnosed with menopause symptoms, and 6 in 10 women are not diagnosed with endometriosis.

According to the World Bank, in 2020, less than 5% of countries reported data on the usage of menstruation products, which is a significant indicator of public health, gender equality, and human rights.

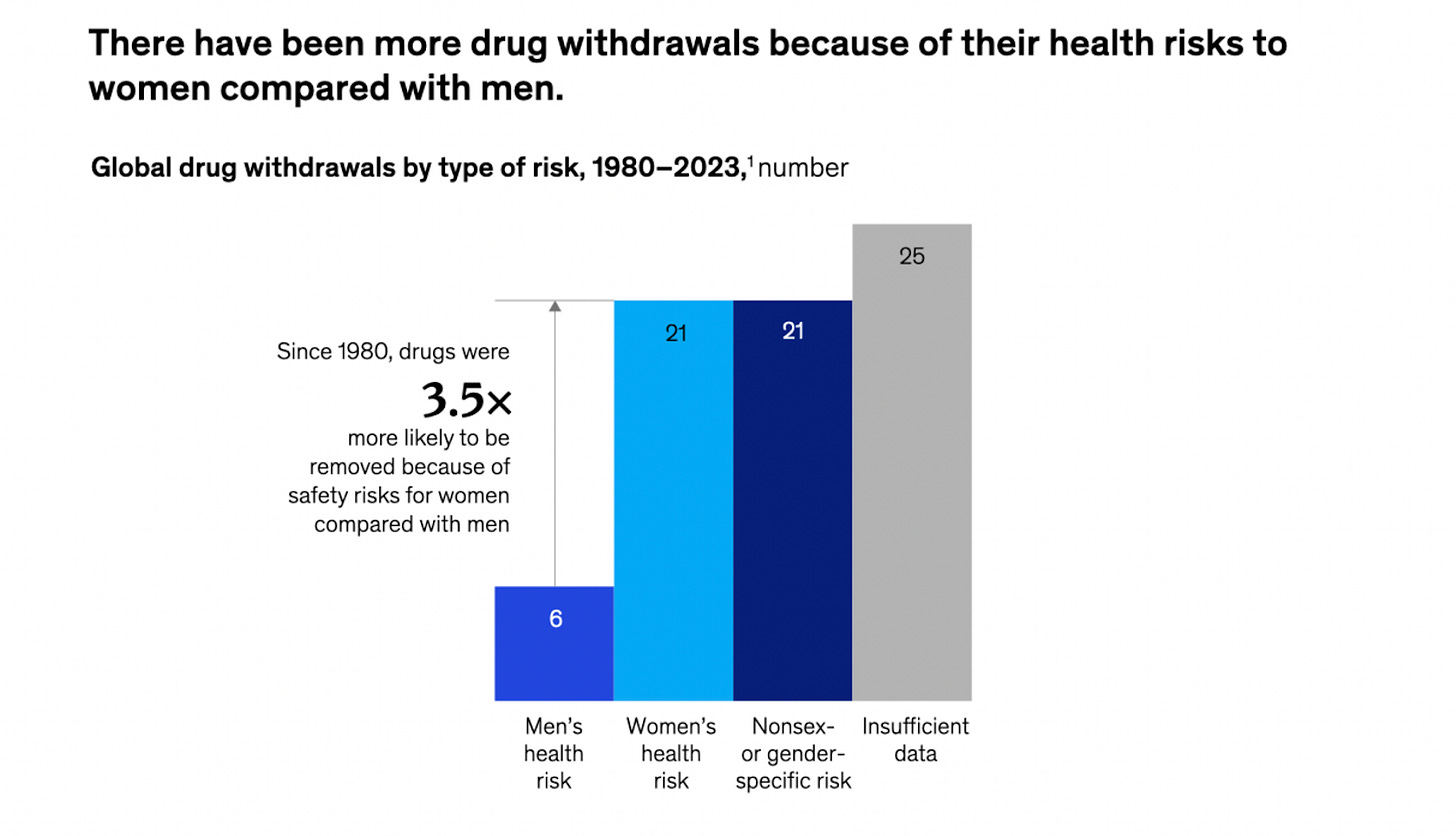

Figure 2

This lack of data has real medical repercussions. As seen in Figure 4, women are 3.5 times more likely to experience adverse medication reactions than men.

This is not surprising given that it took until December 2022 for a study cited by The Femtech Summit to demonstrate that you cannot merely alter the dosage of pharmaceuticals based on body weight for women; they are not “small men.”

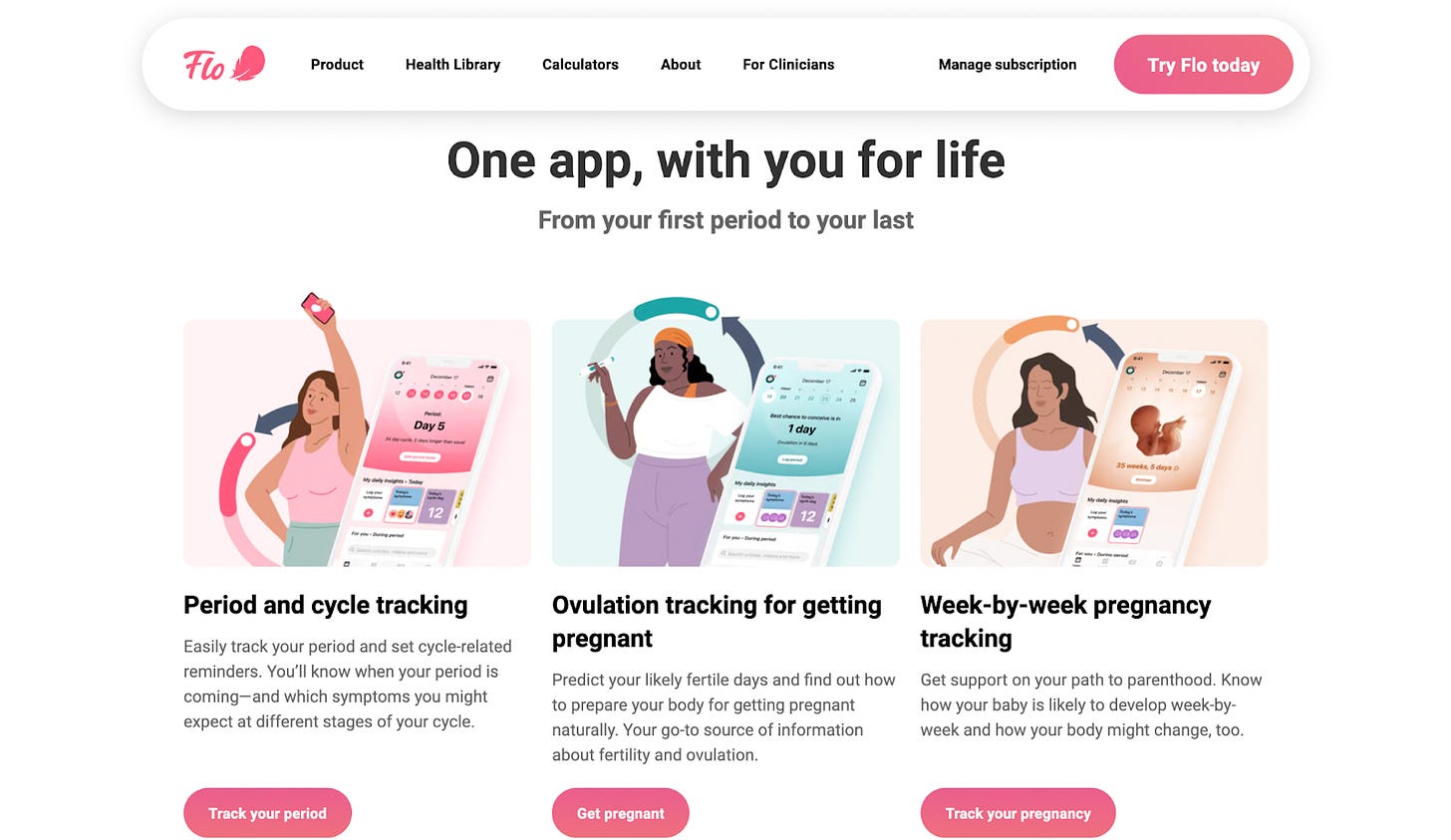

Due to the lack of data, many startups that defined the early Femtech space were tracking platforms such as Flo Health and the Clue app, which have done remarkably well. However, the industry encompasses much more than menstruation and fertility.

Veronika Bridgman at Unravel Health, a diagnostic company focusing on understanding women's hormones, is working to expand into other women-specific health needs such as menopause, polycystic ovarian syndrome (PCOS), and endometriosis.

Veronika wasn’t struggling with conceiving or irregular periods; she just wanted to understand her body better and found there were limited resources to do so.

Her company came about from her frustration with the lack of innovation, saying, “We’ve put men on Mars, and I am still being offered the same treatments 20 years later.”

She believes hormones are the crux of women’s health problems and that we need much broader data to begin to understand women's hormones. In trying to “biohack” her health problems, she found that the one-time hormone paneling data that had been gathered in the past was essentially useless, given that women's hormones are on monthly cycles.

“You can’t contextualize it,” she says. “Fundamentally, as a society, we don’t have information on the thing that rules women’s bodies.”

Veronika and her co-founders took things into their own hands to remedy this. Her company, Unravel Health, is creating comprehensive women's hormonal databases that they can work from to diagnose and treat women better. However, this is work that takes time.

For now, the absence of good-quality data on women's health issues further slows the innovation process, as the length of time required to gather this data can deter VC investors.

Double Standards in Censorship

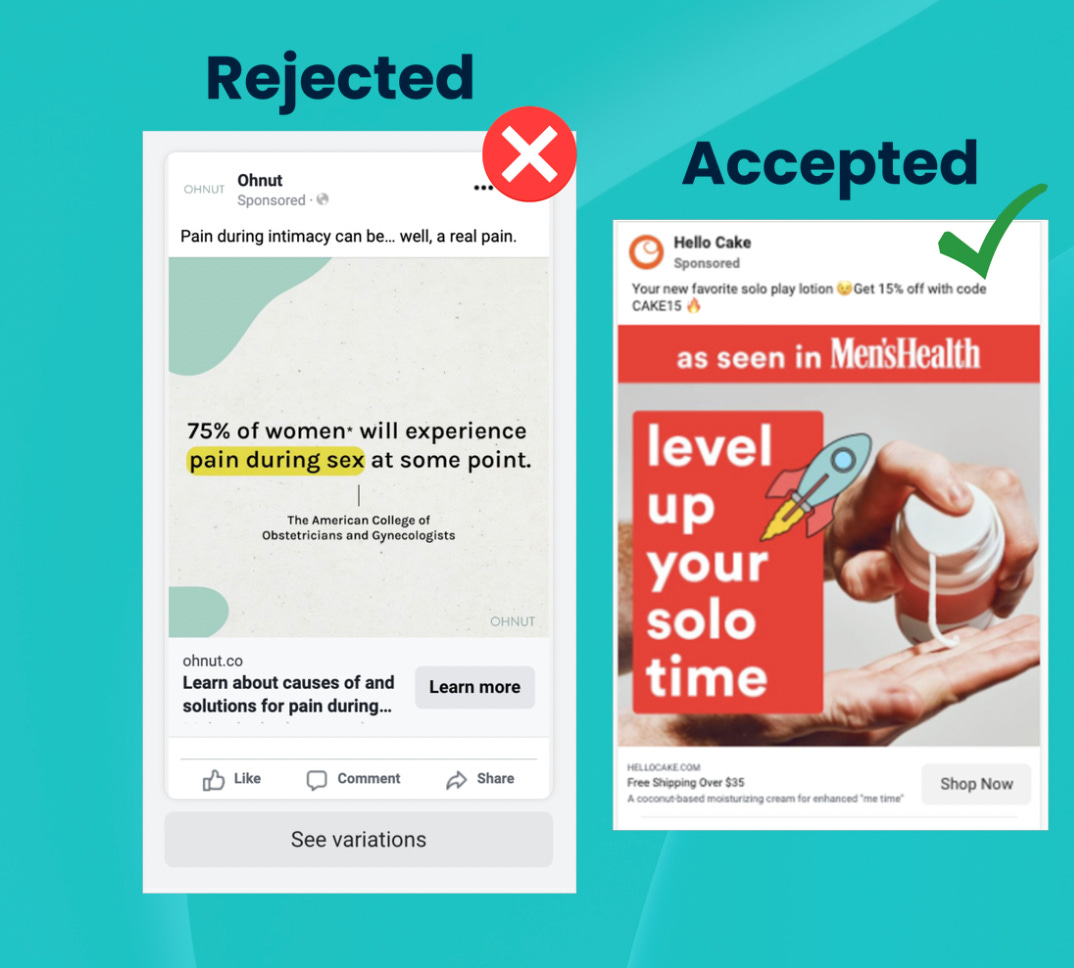

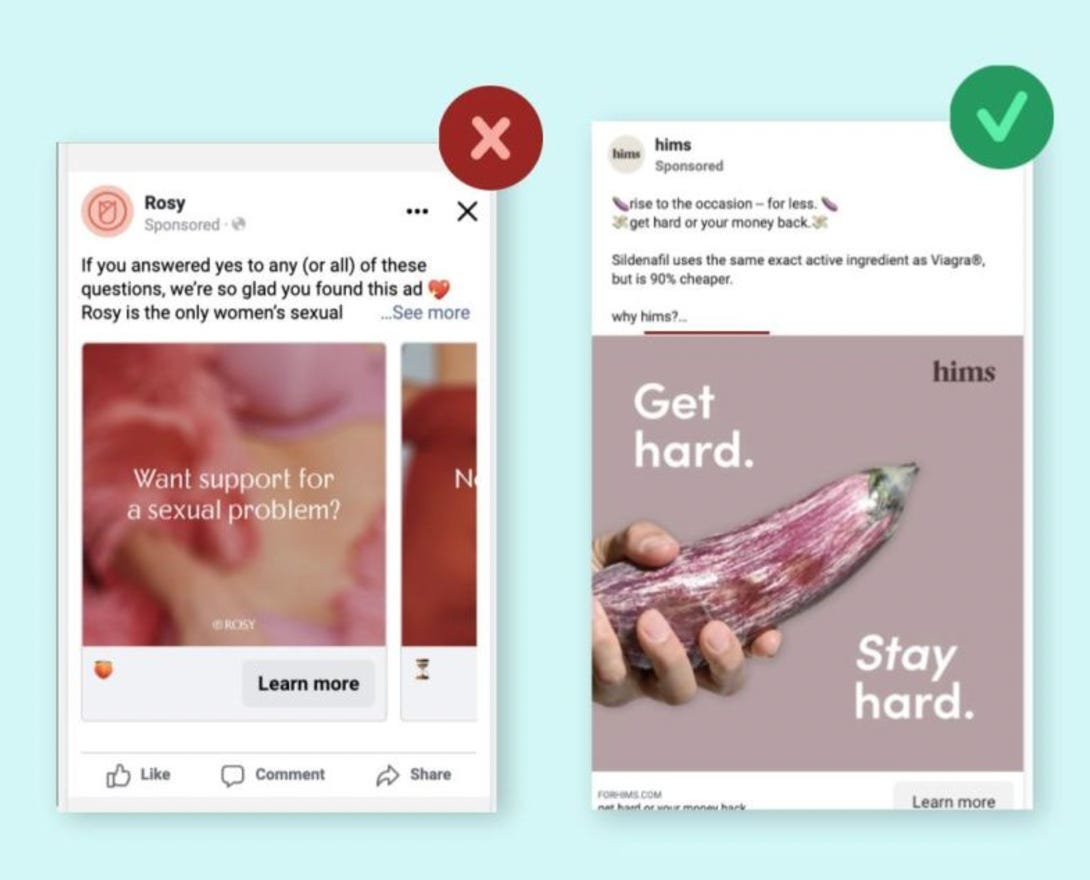

Femtech companies also face harsh censorship that other health tech companies do not. Pictured above in Figure 1 is an ad from Dr. Lyndsey Harper’s company, Rosy Health, that was rejected by Meta, compared to a men’s sexual health ad that was approved.

The Center for Intimacy Justice conducted a study of 60 Femtech companies, and 100% of them had ads rejected by Meta, with 50% having their Meta advertising accounts suspended.

In contrast, men’s health ads do not face the same censorship, as evidenced by the real ads rejected or accepted by Meta in Figures 2 and 3 below.

Figure 3

Figure 4

Dr. Harper continues, saying her company “can’t even breathe” on Meta, is blocked from advertising on the Apple Store, and is severely censored on the news, sharing a story about being unable to say “vagina” during a news segment meant to create a conversation about women's sexual health.

Censorship hugely hampers these companies from growing because it limits their advertising and wastes resources.

Dr. Harper claims her company isn’t doing anything explicitly against these platforms’ policies; “that would be a waste of time.” Yet, her marketing content is continuously rejected, significantly impacting small companies with limited resources.

Due to the “taboo” nature of many women's health companies, Dr. Harper believes that Femtech companies’ best course of action, and the reason her company has been successful, is through integrating into the current healthcare ecosystem.

“Don’t rely on direct-to-consumer advertising,” she warns. Her company, Rosy Health, has had great success getting doctors to recommend the product.

Similarly, Veronika at Unravel is using her direct-to-consumer launch next year as a “data-gathering beta,” she is not expecting to make much revenue.

She explains that companies like hers will work best from a business-to-business model, relying on integrating their service into existing healthcare practices.

Numbers and Big Players

The first companies to make noise in the Femtech industry were tracking software that helped women and doctors understand the female body better. Apps like Flo, the world's current #1 women’s health app with over 380 million downloads, allow women to track and predict their hormonal cycles.

These companies, including Flo, Clue, and Ovia Health, have helped establish Femtech and are valued at $1 billion, $72.32 million, and $84.58 million, respectively.

However, Femtech is not just a fancy name for period trackers, as many often associate it due to its early days.

The Femtech industry was defined by tracking platforms in part due to the need for more and better data on women’s health and partly due to the companies' palatability to investors. Now that the industry is better established, more disruptive approaches to women's health problems can receive the funding they need for innovation.

“Changing,” “evolving,” and “getting better”—these were the terms used by the founders interviewed when asked about their pitching process. That is a significant change from what was said a few years ago.

In her book Invisible Women, Caroline Criado Perez recounts the story of Janica Alvarez, who was seeking funding for a breast pump device in 2013 and was told by an investor, "I'm not touching that; that's disgusting."

You do not hear stories like that these days, and with more female investors in the room, Femtech companies are receiving better feedback.

While female-only founded companies receive only 2.4% of VC funding, the industry's investment has quadrupled since 2018 and is predicted to be valued at $1 trillion by 2040.

Data shows that women will spend 29% more on healthcare than men and are 75% more likely to use digital health platforms. This positions many Femtech companies to be successful.

Women’s health is becoming a national concern, with First Lady Jill Biden announcing $100 million in federal funding for research and development of women’s health solutions in February of 2024.

While there has been a decline in investment since its peak in 2021, when the industry raised $629 million, this is consistent with the market cooling down overall. While there was a 27% decrease in investment in health tech from 2022 to 2023, women-focused health innovation investment grew by 5%.

As of 2024, there are eight Femtech “unicorns,” which are companies valued at over $ 1 billion: Ro Health, Myovant Sciences, Progyny, Kindbody, Flo Health, and Maven Clinic. Interestingly, three of the eight of the most successful Femtech companies listed above don’t exclusively target women.

This indicates that there is still uncertainty in companies only targeting women, and companies that don’t are more likely to succeed. Companies looking to enter the space should explore how they can include men in their solutions.

For example, Kindbody Fertility includes male fertility services while heavily focusing on women’s care, and Flo recently launched “Flo for Partners,” allowing people to track their partner’s menstrual cycles.

Another thread between these successful companies is the importance of data. Progyny, the only company to IPO in 2019, describes itself as “data-driven,” emphasizing its use of data to achieve superior clinical outcomes, cost savings, and exceptional member experiences.

Data is also fundamental to Flo’s model, as it is the #1 downloaded women’s health app and has a vast database that allows for continual improvement. This data-driven foundation is true for all other successful tracking apps that shaped the beginning of the Femtech space.

However, new tracking platforms entering the space today would have little to add, given the size of the incumbents and their existing databases.

Given this, the future of Femtech will move away from these simplistic tracking platforms that the industry started with and instead innovate using the new access to women’s health data.

Further, two of the unicorns, Progyny and Maven Clinic, and many others, including Rosy Health, discussed earlier, have found success in a business-to-business model rather than a direct-to-consumer model by integrating into health plans or employer benefits.

By utilizing the preexisting healthcare systems, their services gain reputability and reach those who may not seek them out themselves.

Another critical aspect of four of the companies—Ro Health, Maven Clinic, Kindbody, and Let’s Get Checked—is their end-to-end support systems. These companies offer doctor support, diagnosis, and treatment from the same platform.

This vertical integration of healthcare is convenient for the user, making them more likely to use the company's services, and it also increases profitability as the company profits from every step of the healthcare process.

The Future of Femtech

Figure 5

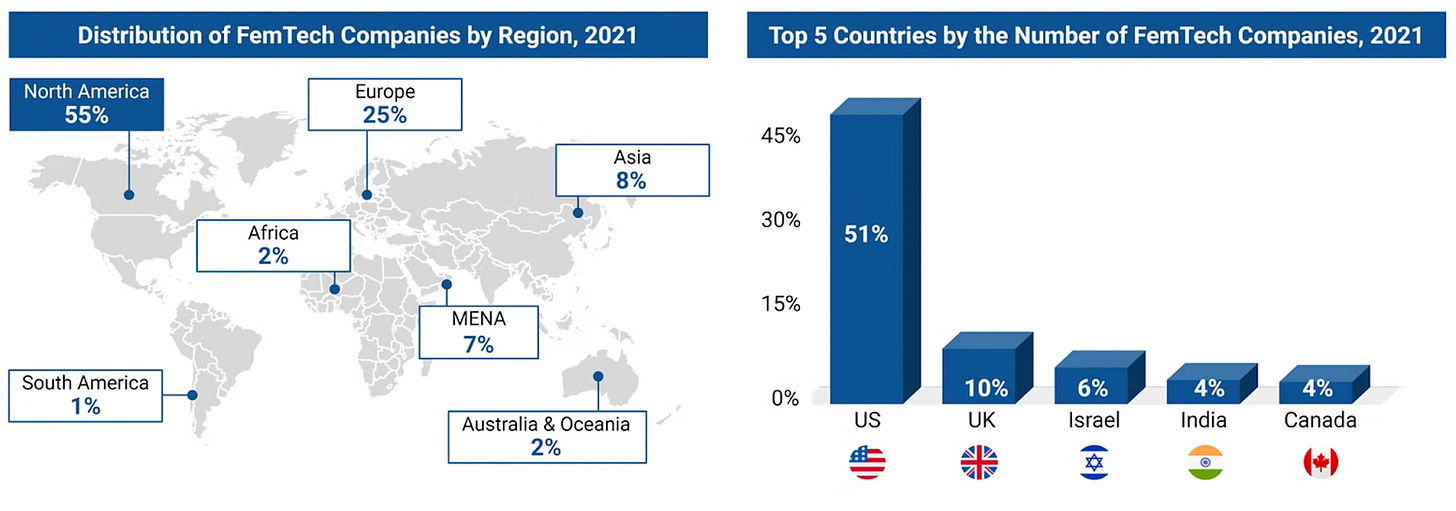

The industry is now well-established in North America and Europe, with the continents holding a combined 80% of the market, as seen in Figure 5. This means there is a unique opportunity in emerging markets where the idea of women-specific healthcare essentially doesn’t exist.

Unsurprisingly, seven of the unicorn companies discussed above are based in the U.S. and the eighth, Flo, is based in London. Even in the most progressive parts of the world, female-focused healthcare companies are very new, and Femtech is almost nonexistent outside of the United States and Europe.

In Southeast Asia, Femtech is a nascent industry, with 77% of current Femtech companies established after 2019. However, 52% of women polled in East Asia said it was unacceptable to discuss women's health issues in public for fear of judgment or shame, leading to a barrier of information that is essential for the industry to succeed.

Growth is continuing, with an expected 54% of nonusers planning to spend on Femtech items next year and 80% of current users planning to spend more on Femtech companies than the previous year.

The industry is projected to be worth $6 billion in Southeast Asia and $4 billion in India in 2024.

In Southeast Asia and India, where women's rights are not as solidified as in the U.S. and U.K., Femtech is even more critical because it allows women to take control of their health, empowering them in all aspects of life.

The key for companies in these markets is to work within the existing healthcare frameworks, adhere to tradition as much as possible to appeal to a large audience and leverage social media as a primary source of information on women's health.

As bright as the future of Femtech seems from an investment perspective, the landscape of the new industry drastically changed in June 2022 with the overturn of Roe V Wade.

The legislation both increased the need for Femtech solutions and limited their use. According to an article from Harvard Business School titled “Doubling Down on Women’s Health Innovation,” demand for more and better contraception will continue to increase given the accessibility of abortion in many places.

Abortion pills, the method 80% of abortions in the United States occur, have seen an increase in investment with the Mifepristone provider Choix, raising $1 million in a pre-seed round just weeks after rumors of the decision began circulation.

The tight time frames in many states also heighten a need for improved maternal diagnostic technology. The decision

Conversely, the decision negatively impacted many women's health companies, particularly in the fertility space. While some women flocked to period-tracking apps like Flo to better understand their menstruation cycles, others deleted the apps out of fear that their information could be used against them if they did unintentionally get pregnant.

In an interview with The Guardian, Sarah Spector, a Texas criminal defense attorney, highlights that “If they are trying to prosecute a woman for getting an illegal abortion, they can subpoena any app on their device, including period trackers.”

While these apps can create policies around how their data is stored and saved, being unable to share the women's health data they collect could stifle innovation in the space, given that increased access to data helped accelerate the industry.

Fertility clinics have also been impacted by ambiguous and overlapping laws, leaving doctors and patients fearful of providing and receiving fertility care.

Karla Torres from The Center for Reproductive Rights says, “While IVF remains legal in the US, the threats to providing and accessing it should not be understated,” detailing the impact on doctors’ ability to freeze or discard unused embryos, manage miscarriages or pregnancy complications; selectively reduce multiple pregnancies; test embryos for genetic imbalances; and access certain medications.

All of this makes entering the fertility space more intimidating for founders and investors.

Figure 6

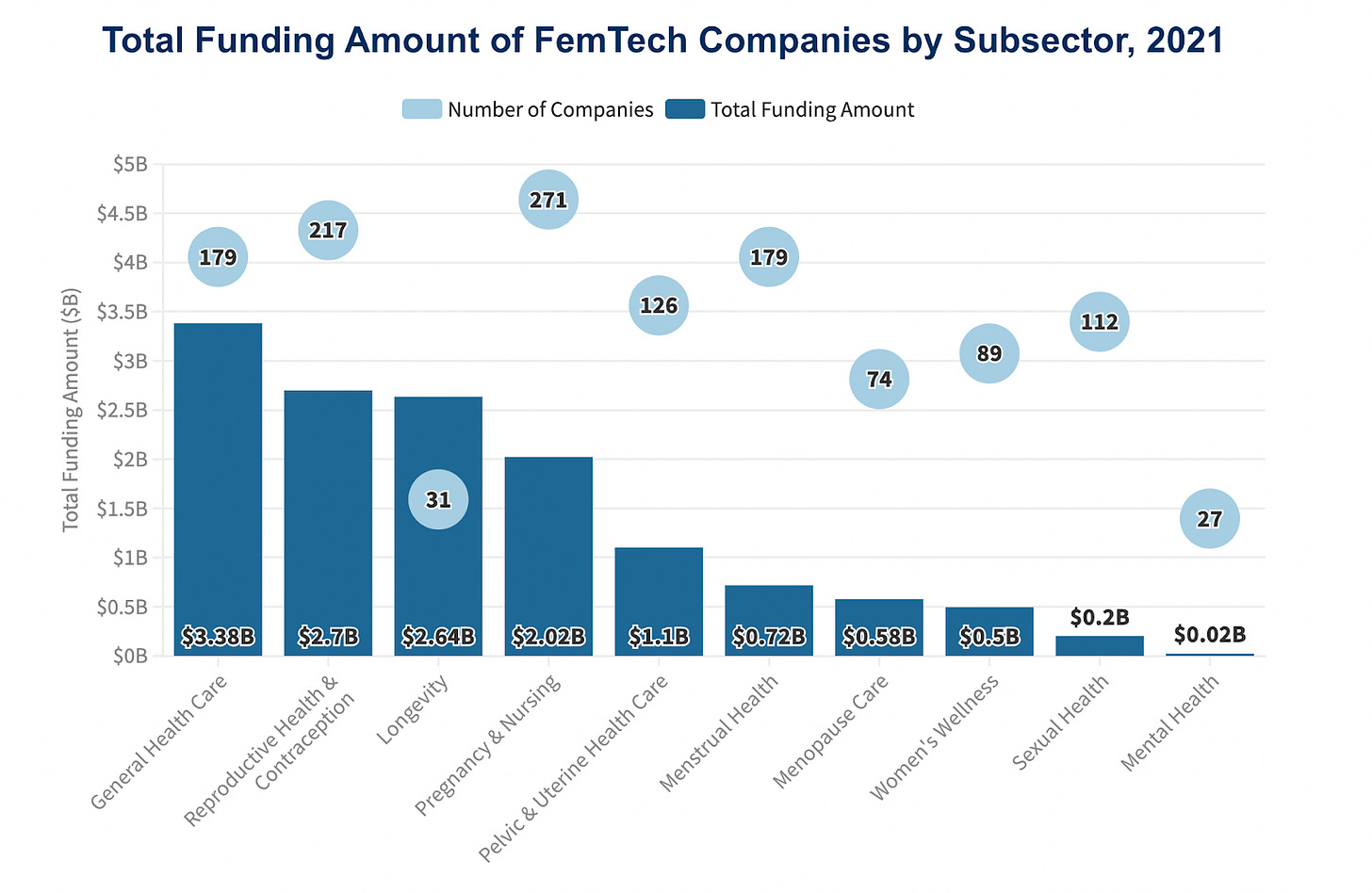

However, Femtech is much more than just reproductive services and period tracking apps, as seen in the distribution in Figure 6 above. Women are no longer willing to settle for the subpar solutions of the past in any aspect of their lives and don’t have to with the technology available today.

Femtech companies are using modern technology to innovate on these archaic ideas of female health, acknowledging that women's bodies are fundamentally different from men's in a variety of ways and finding ways to make female-specific health easier, more comfortable, and accessible.

While these companies face the barriers of limited data, censorship, and bias in the medical field and investing space, they are filling a gap and accessing an untapped market of 50% of the population for the first time. Investors, while skeptical at first, are now seeing the undeniable potential in the Femtech industry not just in the US but around the world.

The reversal of Roe v Wade was a setback for women's health, but it indicates just how much more work there is to be done in the women’s health space, and that begins with investment to allow for innovation.

Terminology: What’s in a name?

Ida Tin, Founder of Clue Health

“Femtech” is the widely accepted term for the industry and is used for this article; however, exploring the controversy surrounding the term is important.

Ida Tin, the founder of Clue, the menstruation tracking app, first coined the term in 2016, saying, “It’s a little easier to say you’re invested in Femtech than, you know, a company that helps women not pee their pants … It kind of bridged the gap over to men as well, which was important, still is important, because so many investors are men.”

However, others feel that the term minimizes women's health issues and unnecessarily pigeonholes companies.

Tania Boler, founder of Elvie, a UK-based medical device company for women that has raised over 170 million dollars, says, "In an ideal world, we wouldn't need Femtech because 51% of the UK population is women. It's not niche."

Anne Wanlund, Founder of Canopie Health, echoed that sentiment, saying that she wouldn’t categorize her company as Femtech and that her goal is to “transcend labels that could be possibly limiting.”

Why would women's health be categorized differently than just “health”?

Dr. Harper acknowledged this feeling as well but ultimately said, “In order to gain recognition, there has to be awareness raised, and that comes with a name. It is a sign of the maturity of the field.”

Being able to categorize their investment as “Femtech” feels more familiar to investors, and ultimately, these companies depend on funding, even if it comes at the cost of correct terminology.

Ultimately, I used the term Femtech for clarity in this article.

Sources

Interviews:

Ikram Geurd, Manager of Global Marketing at Aspivix

Anne Wanlund, Founder of Canopie

Dr. Lyndsey Harper, Founder of Rosy Health

Veronika Bridgeman, Cofounder of Unravel Health